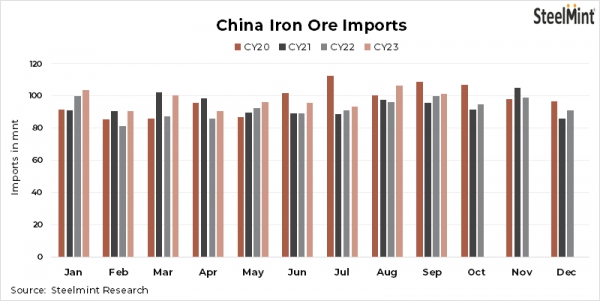

China imported a total of 876.651 million tonnes (mnt) of iron ore and its concentrates during January-September, 2023, an increase of 6.7% compared to last year, according to the General Administration of Customs of the Peoples Republic of China. In September 2023, China imported a whopping 101.18 mnt of iron ore and its concentrates, witnessing an increase of 1.5% compared to the previous year.

Factors behind China's y-o-y rise in iron ore imports

- Higher crude steel output: Crude steel production in China increased by 3% y-o-y to 713 mnt in January-August'23, as per data released by WSA.

- Iron ore port inventory: Iron ore inventory at major Chinese ports fell by 2.6 mnt to 105.9 mnt on 8 October compared to 108.5 mnt on 28 September, according to SteelHome data. Inventories have fallen to the lowest level since mid-July 2020.

- Supportive policies: The Chinese government has introduced supportive policies in the property and infrastructure sectors. A seasonal uptick in the manufacturing industry is expected after the Golden Week holidays.

- Increase in imported prices: The benchmark Fe 62% fines index stood at $121/t in September, against $109/t CFR China in August. The country bought in substantial portions in a bid to stock up ahead of the domestic peak demand season and to also feed its rising crude steel production.

Outlook: Australia's Department of Industry, Innovation and Science forecasts the spot price for 62% Fe grade iron ore to average US$100/tonne (FOB, Australia basis) in 2023, a minuscule $2/t higher than its prior prediction given in July, according to its new resources and energy quarterly report. The price will gain some support mainly from China's construction industry and steelmakers' restocking demand for ore, it noted.

English (UK)

English (UK) Persian (Iran)

Persian (Iran)